extended child tax credit payments 2022

Starting in January 2023 families with incomes of 75000 or less 85000 for married taxpayers filing jointly could get 5 to 30 of the federal credit for each qualifying child. To reconcile advance payments on your 2021 return.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Complete IRS Tax Forms Online or Print Government Tax Documents.

. This year the credit is partially refundable and there is an earning threshold to claim 1400 known as the Additional Child Tax Credit. Last year the souped-up version delivered 3000 for children ages 6 and up and 3600 for younger children. Getty As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000.

It can be used to reduce the size of the recipients tax bill or increase their tax refund. Get your advance payments total and number of qualifying children in your online account. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. Child Tax Credit has now been reduced to a limit of 2000 per child causing many families to struggle to make ends meet.

In 2022 the tax credit could be refundable up to 1500 a rise from 1400 in 2020 due to inflation. You can also refer to Letter 6419. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years old. FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. The most important requirement is the tax return.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. First its worth only 2000 per qualifying child. Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17.

Not only that it would have modified it to include the following. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax.

States Offering Child Tax Credits in 2022 Meanwhile 10 states are granting tax credits with the amount of the benefit and qualifying restrictions varying by state mostly based on the age of the children and household income. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Learn More At AARP.

Most read in money INDEPENDENCE. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. Families only received half so they are waiting to receive the other half this year.

The expanded Child Tax Credit was worth 3000 for children ages 6 to 17 and 3600 for children under 6 in 2021. About half of middle-income parents report spending their child tax credit payments on their mortgage rent utilities or a car payment. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Although the deadline was April 18 families can still file a tax return and apply for eligibility. In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and 3000 for kids 6 to 17. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

The current enhanced child. Money Enhanced child tax credit payments which give checks to families worth up to 1800 per child are set to end in 2021 unless Congress acts. This also means that families will once again have to wait for their tax refund to see the money.

For children under 6 the amount jumped to 3600. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. Please keep this letter regarding your advance Child Tax Credit payments with your tax records.

Depending on your income you must have earned income of at least 2500 to be eligible for the refund. For the first time since July families are not expected to receive a 300 payment on January 15 2022. And although the monthly payments have expired eligible.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. In December 2021 Congress failed to pass the Build Back Better Act which would have extended the monthly CTC payments for one more year. Taxpayers with eligible children will be able to claim a credit worth up to 2000 per child.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up. The bill signed into law by President Joe Biden increased the Child Tax Credit from 2000 to up to 3600 and allowed families the option to receive 50 of their 2021 child tax credit in the form. For the most hard-pressed families the Child Tax Credit reduced food insufficiency among low-income families by 25 percent and had a dramatic impact on cutting child poverty.

Parents E-File to Get the Credits Deductions You Deserve. Enter your information on Schedule 8812 Form 1040. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents.

Moreover in the second half of 2021 it became possible to obtain Child tax credit monthly payments before receiving the other half as a lump sum after tax returns are filed in 2022. As such there was. In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021.

1 Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Will Child Tax Credit Payments Be Extended in 2022.

If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total. The federal tax credit will revert back to 2000 per child maximum per year. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The Child Tax Credit Toolkit The White House

Child Tax Credit Will There Be Another Check In April 2022 Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

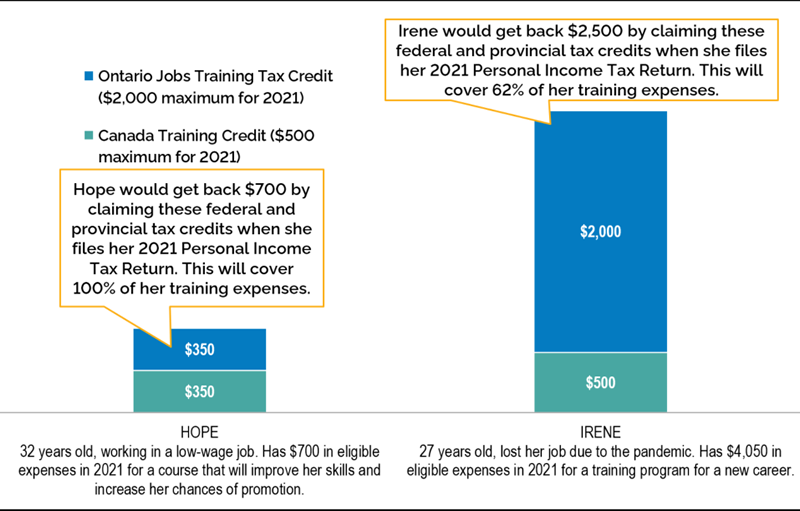

Ontario Jobs Training Tax Credit Ontario Ca

The Child Tax Credit Toolkit The White House

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Advance Child Tax Credit Payments Are Done But You Might Still Be Owed More Here S How To Find Out

The Child Tax Credit Toolkit The White House

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Gauging The Impact Of The Expanded Child Tax Credit S Expiration